Oil stocks have been smashed. The plunging price of oil has dragged them through the floor. As an oil investor, it’s painful to dwell on the effect this will likely have on my passive income.

The world hasn’t yet found a way of living without oil. So, I’m confident about my portfolio in the long term. However, oil price volatility is concerning. And it’s more troubling now than usual because it is combined with the effects the coronavirus-induced economic shut-down.

In these circumstances, it makes sense to try to protect your passive income from as many market volatilities as possible. A balanced, all-weather portfolio can help to achieve this. And in a recession, defensive stocks can be a real comfort blanket.

Should you invest £1,000 in Reckitt Benckiser Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Reckitt Benckiser Group Plc made the list?

Firms in this sector sell goods in constant demand that meet physiological needs. When money is tight, peoples’ spending priorities are on essential items, not buying oil stocks. And these are often reflected in the profitability of those businesses that provide accordingly.

Two best defensive shares

Indeed, hygiene-product seller, Reckitt Benckiser (LSE: RB) depends on hygiene product revenue for 25% of its business. Reckitt owns many well-known brands including Dettol, Harpic, and Cillit Bang. Sales for these items are currently growing due to the Covid-19 pandemic. This should help the firm grow its revenue, profitability, and, hopefully, dividend income.

Moreover, Reckitt’s recent purchase of baby formula maker Mead Johnson provides the consumer staples giant with an extremely profitable consumer health business. And another category leader with pricing power. After a relatively flat period, its long-term prospects are good.

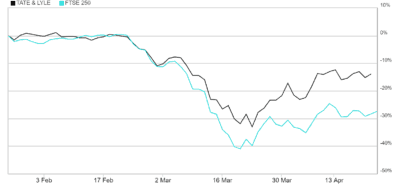

Food is another essential good. I think FTSE 250 star Tate & Lyle (LSE: TATE) is a hidden gem. Tate’s stock has risen by about 75% over the last 10 years but this trend is often overshadowed by the disappointing share price performance of 2016 and 2018.

However, the business has refocused since then. Tate’s 2019 half-yearly results showed sales up 2% and operating profit up 3% from 2018. Its efficiency measures appear to be working and the firm is looking for acquisitions to grow its food and beverage solutions division. Indeed, the firm is currently outperforming the FTSE 250.

Passive income stars

I think both these companies are passive income stars.

Reckitt Benckiser is one of the Top 20 FTSE 100 dividend payers for passive income. These are the few companies that pay out the bulk of dividends across the index. The 2.69% yield is not bad and with a dividend cover of 1.88, it is affordable. Reckitt is currently trading around 6,474p, with HSBC giving it a price target of 6,800p. So, there may be room for growth here too.

Tate & Lyle boasts a juicy yield of just under 4.4.%, high for the food sector. Its dividend cover is 1.64, meaning your passive income is well covered by the firm’s earnings. Also, its dividend per share has improved from 23p to 29p over the last 10 years. And the firm has never missed a payment.

A dividend stock should provide you with a stable passive income by being reliable, unlike oil stocks. Both of these companies have demonstrated this over time. Neither Reckitt nor Tate are likely to offer you big upsides in a bull market. But right now, the predictable nature of the businesses and the sustainable dividends on offer are trade-offs I’m delighted to make.